California new home purchases are the choice of many home buyers. It's a different process. Hire an agent to deal for you.

Navigating the waters of a new home purchase means getting intensely curious about what the purchase entails. You don’t know what you don’t know until you ask. It’s a Saturday afternoon and as you drive down the freeway you notice billboards advertising a new home subdivision at the next exit. You take that exit and find yourself driving past empty home sites, some with little sticks in the ground, and you follow directional signs and flags to a model home complex.

You realize you’re not in Kansas any more when walking into a sales office that takes the place of a home’s three-car garage. A friendly, well-dressed salesperson greets you, guiding you over to a center island graphic set-up meant to give you an overview of the neighborhood. As you gaze into its depths, you see tiny, meandering streets and colored shapes representing homes.

Should you waive your home inspection to improve your offer?

Many home buyers think waiving the home inspection in hopes that the seller will review their offer more favorably. Think very carefully and have a pot full of money set aside just in case.

Okay. It may sound bureaucratic and boring. But there are a number of precautionary contractual conditions for any purchase agreement recommended by the Realtor community that protects home buyers from liability as well as poor decision-making. And no matter how competitive the bidding for a home, they'll advise you to include them. One of them is a home inspection.

Home ownership remains a goal for many couples. But what about the singles who dream of it as well?

According to Zillow, saving for a down payment is no walk in the park for future home buying couples, but an even more challenging prospect to singles, for whom it may take up to 11 years to save up for a down payment for a typical U.S. home (even longer in pricey markets). This is more than twice the time it takes a married or partnered couple.

Statistics show nationally that fewer than half (45 percent) of all U.S. homes are affordable for credit qualified single buyers. Couples, by contrast, could afford 82 percent of all homes. Banks are not allowed to discriminate based on marital status, but tighter lending standards can potentially pose a challenge to single buyers because they only have their own income to qualify for a loan.

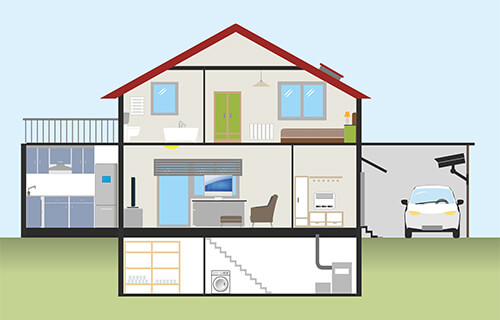

Multi-generational households are becoming normal. We understand and can help.

According to Audrey Hoffer at the Washington Post, multi-generational households are becoming more common now than in past decades. Ever since the Recession this living arrangement that can include grandparents, parents, and grown children is becoming a notable study in the changing household demographic.

During the last year of the Great Recession (2009) 17 percent of Americans lived in households that were multigenerational, according to a senior writer and editor at Pew Research Center. This means 51.5 million people were living in homes with either grandparents and grandchildren, or with two or more adult generations, all based on census data. It's estimated that about 20 percent of Americans — 64 million people — playing checkers, fighting over bathroom rights, or watching TV with another generation. And yes, it’s a new record.

Where should I start when buying a home? Should I look at homes or mortgage first.

"Hello, We're in the process of hopefully purchasing our first home, and I'm a little lost on everything that is going on. What's the best advice you would give to first-time home buyers?"

Mortgage First

Without question, your first step in the home buying process is to begin getting your financing in order. I realize this may seem like slightly self-serving advice since I am in the mortgage business, but the fact is that most people who buy homes today do so with a mortgage. That part is often the most challenging, with far more moving parts and potential snags than in years past.

Myths about Realtors® that should go away.

We're real estate agents too and many of our loan clients don't understand the value of a good agent.

People often believe a real estate agent is simply someone who knows about homes for sale in their area, hammers signs into front yard lawns, and makes a slew of money just showing up at an open house. A no-brainer, right?

Is a 20% down payment standard? What's the deal on mortgage insurance?

A 20% down payment is anything but standard. Making a smaller down payment does involve some form of mortgage insurance (MI). This is a fee paid to limit the lender's risk when there is a lower down payment.

Conventional loans are available with as little as 3% down. The cost of the mortgage insurance depends on the borrower's credit score. Lenders will allow borrowers to drop the monthly MI once the loan-to-value ratio reaches 80%. They will typically require an appraisal (about $600) to show the value, and the loan should have been in good standing for at least the previous 12 months. Different lenders have different procedures, though, so it is worth making a call to them to get their specifics.