Leasing out my condo instead of selling

Question: I took out a Mortgage 3 months ago for a condo with full intentions of occupying it myself. However, due to a death in the family, I inherited my parents’ house. If I went back to live in that house and leased my condo, would this be illegal?

It would not be "illegal," but it may be in violation of the terms of your mortgage. Most lenders price their loans differently for investment properties than for those that will be owner-occupied.

You would have signed a document indicating your intention to occupy the property at the time of taking the loan. There are three likely possibilities:

How does the appraisal process work? Why isn't it just the price we agree to pay?

The oldest argument in the real estate book is "the value of a home should be what a reasonable seller and buyer agree to." They argument is mostly correct if it's a cash sale, but if a lender involved an appraisal will be required.

How does a full appraisal really work? The appraisal process is a combination of science and opinion—but mostly science, even though the value that the appraiser delivers is called an “opinion of value” as of the effective date of the appraisal. It's very much the same process a listing agent will use to determine the best sales price in a comparative market analysis.

Credit is perfect, but my score is not. Does that affect my rate?

Is there a difference in loan rates for borrowers with credit scores over 740? Only at the water cooler.

"I have a credit score of 776 out of the possible 850, even though I have always paid my full credit card balances on time for almost 20 years. I have lots of credit cards because I usually open them to get offers like miles. Some of them have credit limits of $10K, or $15K. If I'm getting these offers, it seems like my score should be higher."

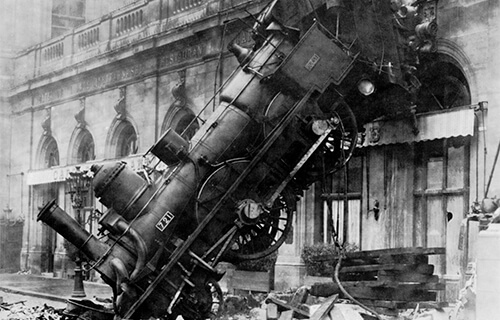

Yes, your home inspection can go totally off the rails.

You’d think it was among the simplest of tasks to check off once you’ve had an offer accepted for a home you hope to buy. The home inspection. But like anything else, this can go really wrong if you don’t use good sense along the way.

Let’s look at all the ways that is possible.

Should I request an increase in my credit limit to increase my credit score?

"I only have one 2,000$ credit limit credit card. I always pay my bill on time in full every month . Should I get another credit card or request an increase in my current limit for a better credit score?"

Paying your credit card balance in full is always a good idea, for two reasons.

First, the obvious: revolving credit is extremely expensive—upwards of 30% in some cases. Even a 9% card is high, compared to other forms of financing such as mortgages and car loans.

Purchase and Renovate in One Close

Is it possible to include extra funds for renovations in a loan for a new house? Yes, and it's a great idea.

Purchase and renovation loans are an excellent way to buy a home that needs work and turn it into your dream home in a single transaction. Purchase and renovation loans are available in government and conventional programs and provide a more affordable home ownership option and an opportunity to beat the market.

Avoiding mortgage insurance by using your 401K? Do the math first.

It’s not a sin to pull money from your 401K, but whether you decide to put down more cash to avoid mortgage insurance is entirely up to you. Here’s some information to help you decide.

When lenders consider risk on a loan, the loan-to-value ratio is one of the factors they evaluate. A loan for more than 80% of the property’s value presents a greater risk in their view. To manage that risk, they require mortgage insurance which is usually paid monthly and added to the payment.